Inpatient hospitalisation expenses: Room including nursing charges: Up to 1% of chosen sum assured ICU charges: Up to 2% of chosen sum assured Expenses incurred with respect to treating medical professionals, consumables, equipment, supplies, OT and other required rooms, necessary tests etc.: Up to chosen sum assured No-claim discount: 3% - 15% on renewal premium first discount awarded after 3 successive claim- free years and annually thereafter Rs.1 to 5 lakhs in increments of Rs.50,000 Rs.5 to 10 lakhs in increments of Rs.1 lakh (chosen sum assured can be enhanced at renewal) (50% of costs reimbursed on qualification)įloater (Family includes self, spouse and dependent children) 3 months for children, provided at least one parent is also covered To enhance the basic chosen sum assured, policyholders under this plan can also choose two add-on covers to meet ambulance and hospitalisation costs.ġ8 yrs to 80 yrs.

United India Insurance Family Medicare Policy:Ī health insurance policy which aims to cover both the proposer and his/her family. United India Insurance Personal Accident Policy.United India UNI Criticare Health Insurance.United India Insurance Super Top-up Policy.United India Insurance Senior Citizen Plan.United India Insurance Individual Mediclaim Policy.United India Insurance Family Medicare 2014 Policy.United India Insurance Family Medicare Policy.These policies couple coverage with affordability, making them viable insurance products for a large cross-section of the Indian insurance market. Health insurance policies form an integral part of its product portfolio.

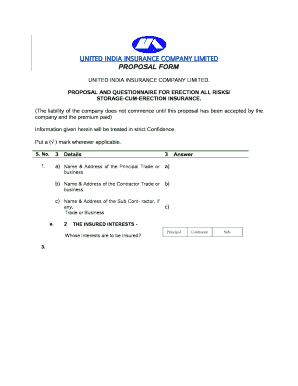

The company’s main strength is its ability to develop solutions to meet the financial protection needs of a wide variety of clients, corporate or rural. It also services lower economic strata through micro-offices which they have established in over 200 towns. In addition to serving urban and semi-urban clients, United India actively participates in government-run programmes aimed at extending insurance to rural market segments. It now has over 1,340 offices channelling a variety of insurance products to a customer-base of over 1 crore clients. The company has since bolstered its presence across the country by expanding its distribution network. is a public-sector general insurance provider that was formed in 1938 and nationalised in 1972.

0 kommentar(er)

0 kommentar(er)